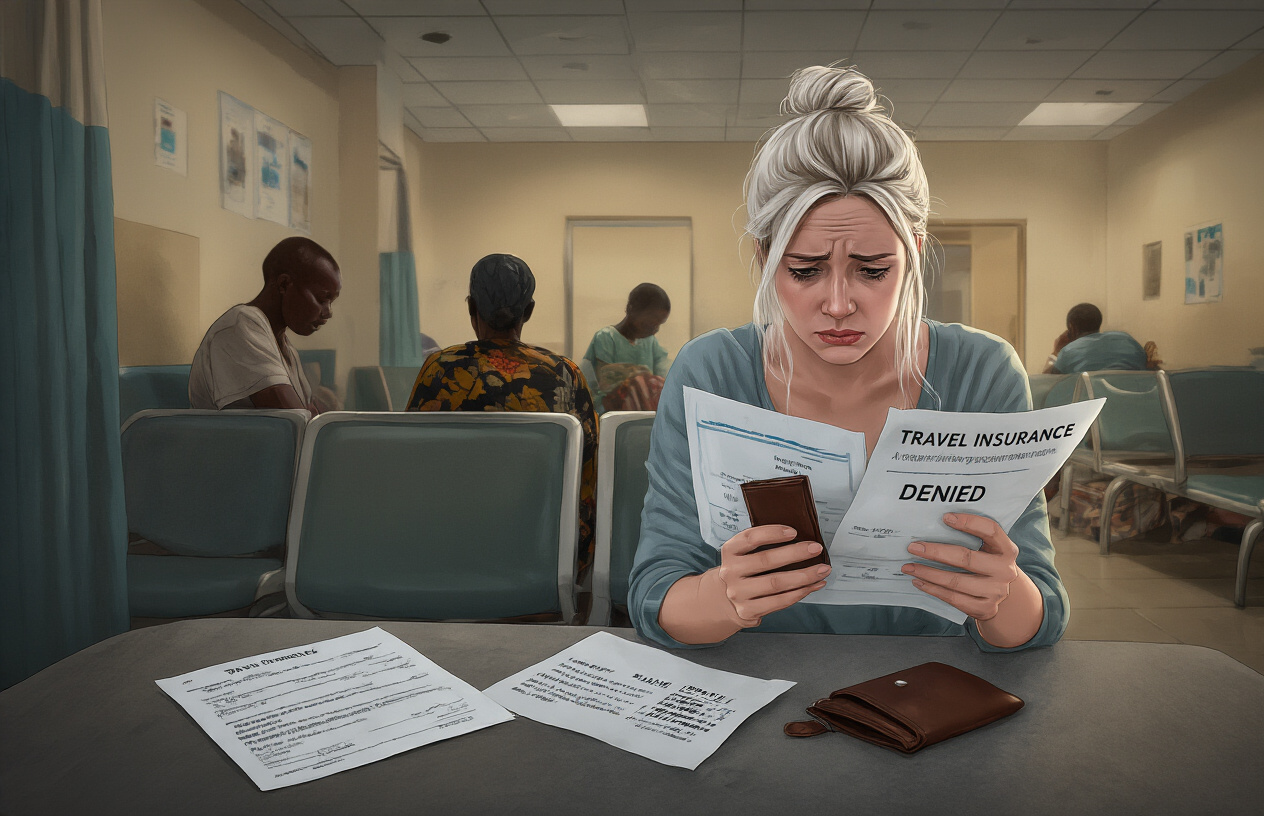

Imagine you’re stranded in a rural Tanzanian clinic, clutching your passport, facing a $5,000 medical evacuation bill. Your dream safari has become a financial nightmare. Every year, thousands explore Africa’s breathtaking landscapes—Serengeti’s golden plains, Kilimanjaro’s majestic summit, Zanzibar’s turquoise waters—without travel insurance for Africa. They’re risking their savings and peace of mind.

I am a tour guide with 15 years of experience across Africa. I’ve seen how travel insurance for Africa transforms crises into manageable challenges. Sudden illnesses can occur. Wildlife mishaps are also possible. This is why travel insurance for Africa is essential for your adventure.

Table of Contents

Medical Emergencies Can Bankrupt Your Trip

Africa’s remote regions and varied healthcare systems make travel insurance for Africa indispensable. Medical emergencies can incur staggering costs, and without coverage, you’re vulnerable. Here’s why travel insurance for Africa is critical.

A. High Evacuation Costs in Remote Areas

Africa’s iconic destinations are often far from modern hospitals. During a game drive, Sarah, a 32-year-old from Chicago, collapsed from severe dehydration. She was on a 2024 safari in Tanzania’s Serengeti. The nearest clinic, three hours away over rutted tracks, lacked IV fluids or diagnostics. The closest suitable hospital was in Nairobi. It was 250 miles away.

A private plane with medical staff was needed to land on a dirt airstrip. The cost? $45,000 for the evacuation, plus $5,000 for initial treatment. Sarah’s travel insurance for Africa from World Nomads covered $500,000 in evacuation costs. This insurance spared her from financial ruin. In remote areas like Botswana’s Okavango Delta or Namibia’s Skeleton Coast, evacuations can cost $100,000 due to distance and logistics. Providers like Allianz Global Assistance, offer up to $1,000,000 in medical evacuation coverage.

B. Expensive Private Healthcare

James, a British retiree, visited Cape Town in 2023 and contracted pneumonia. His four-day stay in a private hospital, including diagnostics and medication, cost $7,800. Public hospitals, while cheaper, often face overcrowding and shortages. Cities like Johannesburg, Cairo, and Nairobi boast private hospitals with world-class facilities, but these are often prohibitively expensive for foreigners.

In rural areas, clinics often lack electricity or basic medical supplies, making them unreliable. James’s travel insurance for Africa from Travelex covered the entire bill. It ensured quality care without financial stress. Without travel insurance for Africa, he’d have faced a tough choice: pay thousands or risk substandard care.

C. Tropical Disease Costs

Africa’s unique health risks—malaria, dengue fever, and yellow fever—carry hefty price tags. Maria, a Canadian backpacker, contracted malaria in Uganda’s Bwindi Impenetrable Forest in 2022. First outpatient treatment cost $300, but when the infection worsened, she needed a week in a Kampala hospital, totaling $18,000. Her travel insurance for Africa was from Seven Corners. It covered all costs, including IV treatments and follow-up care.

Typical costs include:

- Malaria: $200–$1,000 outpatient; severe cases up to $20,000.

- Dengue Fever: $500–$2,500, escalating with complications.

- Yellow Fever: $1,000–$5,000+, especially for intensive care.

- Severe Food Poisoning: $500–$3,000 for hydration and antibiotics.

Without travel insurance for Africa, these expenses can bankrupt travelers. Companies like InsureMyTrip, help find policies covering tropical diseases.

D. Why Evacuation Coverage is Non-Negotiable

Medical evacuations involve specialized planes, trained crews, and border clearances, making them astronomically expensive. In 2023, Tom, a hiker in Rwanda’s Volcanoes National Park, suffered a severe allergic reaction to a bee sting. His travel insurance for Africa from VisitorsCoverage arranged a $30,000 helicopter evacuation to Kigali. It covered medical escorts and international transport. Many African parks, like Tanzania’s Ngorongoro, need proof of travel insurance for Africa with evacuation coverage for entry.

Wildlife Encounters Pose Unique Risks

Africa’s wildlife is thrilling but unpredictable. Travel insurance for Africa protects against risks that domestic insurance rarely covers.

A. Safari Accidents and Injuries

In 2024, Emma, an Australian photographer, was on a safari in Kenya’s Masai Mara. Her jeep hit a deep rut, throwing her against the roll bar and fracturing her wrist. Treatment at a Nairobi clinic, including X-rays and a cast, cost $4,500. Her travel insurance for Africa from Travel Guard covered the expenses, ensuring she continued her trip.

Safari vehicles navigate rough terrain, and accidents—minor cuts to broken bones—are common. Check that your travel insurance for Africa covers adventure activities, as some budget policies exclude safaris.

B. Animal-Related Incidents

Wildlife encounters extend beyond vehicles. In 2022, Mark, a British tourist, stayed at a bush camp in Botswana. During his stay, a baboon stole his $1,200 camera bag. Later, a scorpion sting required $3,000 in medical treatment, including antivenom. His travel insurance for Africa from SafetyWing covered both the medical costs and property loss.

- Medical treatment for bites or scratches ($2,000–$5,000 for rabies shots).

- Property damage by animals.

- Alternative accommodations if wildlife renders lodging unusable.

C. Emergency Response in Remote Parks

Africa’s national parks, like Kruger or Serengeti, are far from medical facilities. In 2023, Lisa, a German traveler, sprained her ankle hiking in South Africa’s Kruger National Park. A $25,000 helicopter evacuation was needed to reach a hospital in Johannesburg. Her travel insurance for Africa from HTH Worldwide covered the cost.

Adventure Activities Require Special Coverage

Africa’s adventures—mountain climbing, diving, trekking—need tailored travel insurance for Africa.

A. Climbing Kilimanjaro and High-Altitude Coverage

Scaling Kilimanjaro (5,895 meters) is a bucket-list goal, but standard policies often cap coverage at 4,000 meters. In 2023, Alex, a U.S. climber, suffered altitude sickness at 5,000 meters. His evacuation by helicopter cost $15,000, plus $5,000 for treatment in Arusha. His travel insurance for Africa from WorldTrips, covered high-altitude risks, saving him from a massive bill.

B. Water Sports and Diving Protection

Africa’s coastlines are water sports havens. In 2024, Sophie, a French diver, experienced decompression sickness off Zanzibar, requiring $35,000 in chamber treatment. Her travel insurance for Africa from Just Travel Cover covered the costs, including damaged diving gear. Diving policies cover treatments, evacuations, and equipment loss.

C. Off-Road Excursions and Remote Trekking

In 2022, a group I guided in Namibia’s Kalahari Desert faced a vehicle breakdown, stranding them 200 miles from help. A $20,000 extraction was covered by their travel insurance for Africa from InsureMore. This off-road coverage handles rescues and provides medical care in remote areas.

D. Helicopter Rescue for Extreme Adventures

Helicopter rescues are vital for extreme adventures. In 2023, Paul, a U.K. hiker, fell in Uganda’s Rwenzori Mountains, requiring a $40,000 airlift. His travel insurance for Africa from World Nomads covered the rescue, ensuring safe treatment in Kampala.

Protect Against Trip Cancellations and Interruptions

Unpredictable events can derail plans. Travel insurance for Africa safeguards your investment.

A. Political Instability

Africa’s political landscape can shift rapidly. In 2022, Claire’s $5,000 Zimbabwe safari was canceled due to election-related unrest. Her travel insurance for Africa from Allianz refunded the full amount.

B. Rainy Season Disruptions

Africa’s rainy seasons can wash out roads or ground flights. In 2023, heavy rains in Tanzania stranded a group I guided. Their travel insurance for Africa from Travelex covered $2,500 in rebooking fees and accommodations.

A good policy covers you when:

- Your safari gets canceled because vehicles can’t navigate flooded terrain

- Connecting flights get grounded in Nairobi due to thunderstorms

- Your Nile River cruise gets postponed because of dangerous water levels

C. Airline Reliability Issues

African airlines face frequent delays or cancellations. In 2024, a delayed flight in Addis Ababa caused Maria to miss a safari connection. Her travel insurance for Africa from Seven Corners covered $1,200 in rebooking and hotel costs.

Insurance covers the domino effect of these disruptions. These include missed connections, emergency hotel stays, and rebooking fees. Without insurance, these expenses would otherwise empty your wallet.

Safeguard Your Valuables and Equipment

Africa’s environments pose risks to belongings. Travel insurance for Africa protects your gear.

A. Camera Gear Protection

In 2023, John, a photographer, lost a $4,000 DSLR to water damage in Botswana. His travel insurance for Africa from InsureMyTrip reimbursed the full amount.

B. Theft in Tourist Areas

Crowded markets in Marrakech or Cape Town are theft hotspots. In 2022, Anna’s wallet was stolen in Nairobi. Her travel insurance for Africa from VisitorsCoverage provided emergency cash and passport replacement assistance.

The real kicker? Insurance companies have 24/7 assistance teams. They know exactly which local police station you need to file reports with. Additionally, they can guide you through the process in real time.

C. Lost Luggage Solutions

Lost luggage can disrupt a safari. In 2024, Tom’s bags went missing in Tanzania. His travel insurance for Africa from Travel Guard provided $150/day for essentials, ensuring his trip continued.

Most policies also help track down your luggage through airline systems and compensate you if items are permanently lost.

D. Electronic Device Coverage

Africa’s sand and humidity can ruin devices. In 2023, Lisa’s phone was damaged at Victoria Falls. Her travel insurance for Africa from SafetyWing covered a $1,200 replacement.

Some premium policies even include data recovery services. Because losing those once-in-a-lifetime gorilla trekking photos hurts more than losing the actual device.

Local Healthcare Systems Vary Dramatically

Africa’s healthcare varies widely, and travel insurance for Africa ensures quality care.

A. Urban vs. Rural Disparities

Private hospitals in Cape Town rival Western standards, but rural clinics often lack basics. In 2022, a traveler I guided broke her ankle in rural Rwanda, requiring a four-hour drive to Kigali. Her travel insurance for Africa from HTH Worldwide ensured access to a vetted hospital.

Without insurance, you’re gambling on where you get sick or injured. And trust me, adventures rarely happen next door to modern hospitals.

B. Language Barriers

In rural areas, language barriers complicate emergencies. In 2023, a traveler in Mali used travel insurance for Africa from Just Travel Cover. It provided translation services. This ensured the traveler secured prompt care.

Insurance companies offer translation services and medical evacuation when communication becomes impossible. They become your voice when you literally don’t have one.

C. Insurance-Approved Networks

Insurers like WorldTrips keep networks of trusted hospitals. These networks guarantee direct billing and quality care. This makes travel insurance for Africa a vital tool.

These networks include direct billing arrangements. You won’t have to empty your wallet upfront. This also means you can avoid navigating complicated reimbursement processes while sick.

Your insurance card essentially becomes a VIP pass to the best available care wherever you are. Without it, you’re just hoping for the best in unfamiliar territory.

Peace of Mind Makes Your African Adventure Better

Travel insurance for Africa offers intangible benefits.

A. 24/7 Emergency Assistance

In 2022, a client in Morocco used travel insurance for Africa from InsureMore. They replaced a stolen passport via their 24/7 hotline. This solution helped them avoid bureaucratic stress.

B. Family Support

During a medical crisis, insurers like Allianz update families and arrange travel for loved ones, easing stress.

C. Documentation Help for Emergency Situations

Lost your passport in Cape Town? Wallet stolen in Nairobi? Your insurance team will guide you on exactly what to do. They will tell you which police stations to visit and which forms to fill out. They’ll even help you get emergency replacement documents. Trust me, navigating bureaucracy is the last thing you want to deal with when you’re already stressed.

D. Coverage that Follows You Across Multiple African Countries

Africa isn’t one place – it’s 54 countries with different healthcare systems and safety situations. Good insurance follows you whether you’re on safari in Kenya, exploring markets in Morocco, or island-hopping in Seychelles. No need to buy separate policies or worry about coverage gaps when crossing borders.

E. Stress-Free Travel Through Uncertain Territories

Some parts of Africa have political situations that can change quickly. The right insurance keeps you informed about areas to avoid and covers evacuation if things get dicey. This isn’t about fear – it’s about freedom to explore with confidence, knowing you have backup if the unexpected happens.

Investing in travel insurance for your African adventure is more than a precaution—it’s an essential part of responsible travel planning. Comprehensive coverage provides crucial financial protection. It covers potential medical emergencies and wildlife encounters. It also addresses adventure activity risks and varying healthcare standards across the continent.

Pingback: Top 15 Unforgettable Activities To Do In Cape Town, South Africa | Must-See Attractions

Pingback: Conquer 10 Common Travel Problems: Your Guide To Joyful Journeys